Blog

401k Plan Considerations for Merger & Acquisition

October 5, 2022

While integrating retirement plans due to a merge or acquisition can have its administrative challenges, it also provides a unique opportunity to capitalize on the strengths of the underlying plans and improve benefits for all employees involved. The key is starting early, working with an experienced advisor, collecting reliable data in the due diligence process, and effective employee communication.

While integrating retirement plans due to a merge or acquisition can have its administrative challenges, it also provides a unique opportunity to capitalize on the strengths of the underlying plans and improve benefits for all employees involved. The key is starting early, working with an experienced advisor, collecting reliable data in the due diligence process, and effective employee communication.

What types of 401(k) plan design changes are mandated and allowed?

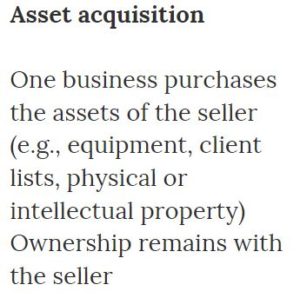

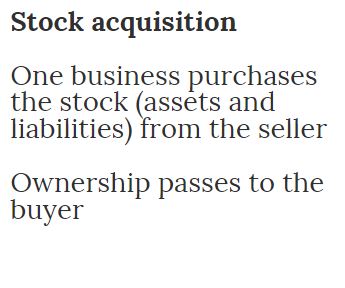

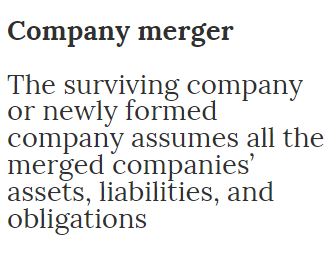

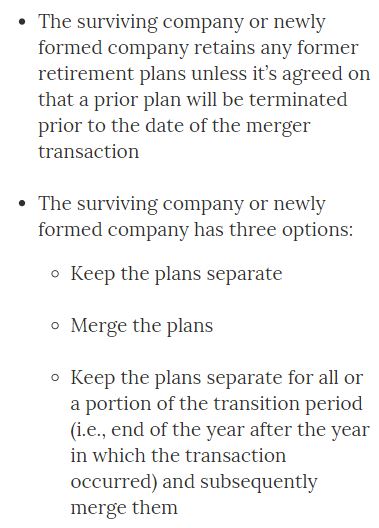

Here’s a brief review of the requirements under ERISA and the Internal Revenue Code (IRC) of actions companies are required to take with their 401(k) plans because of their planned merger or acquisition.

What types of 401(k) plan design changes are mandated and allowed?

Here’s a brief review of the requirements under ERISA and the Internal Revenue Code (IRC) of actions companies are required to take with their 401(k) plans because of their planned merger or acquisition.

|

|

|---|---|

|

|

|

|

|

|

There are many additional due diligence, regulatory and legal issues to know about and address when merging retirement plans amid a merger or acquisition including merged plans must pass IRS coverage tests in the aggregate.

How does an M&A affect employees?

If retaining and rewarding employees, including highly compensated employees (HCEs), are key objectives, then it’s important to conduct wide-ranging analysis to understand how the plan transition will affect employees from both organizations.

This should include:

- Employer contributions, auto-enrollment, and auto-escalation, as well as other elements and Safe Harbor protections available through plan design

- The type and quality of available investment options

- The availability of nonqualified deferred compensation, cash balance provision, and other supplemental plans

- Retirement readiness evaluation among HCEs and any planning services or testing strategies in place for dealing with IRS contribution limits

This analysis will fuel ongoing discussions about the goals, objectives, and long-term future of the retirement program after the M&A transaction—and whether the plans need to be optimized or if an HCE-targeted strategy, such as a nonqualified plan, might be appropriate.

Regardless of the plan decisions, communication about any enhancements and other changes to the retirement plan program following an M&A is critical to maintain and boost employee morale, loyalty, and overall productivity.