Blog

Small Businesses Owners: Ready to Start a Company Retirement Plan?

June 15, 2022

Comparing retirement plans:

401(k) vs. Simple IRA vs. SEP IRA

As an employer, a company retirement plan may help you:

- Save for your own retirement

- Receive tax credits and other government incentives

- Attract — and keep — better employees

- Realize increased worker productivity

- Deduct all employer contributions from current taxes

- Allow employees to save more money for retirement through most small-business plans than they might otherwise be able to save on their own through an individual retirement account (IRA)

Some common questions from Business Owners:

- Do I have enough employees to start a plan?

- There are plans for businesses of every size, even if you don’t have any employees.

- Aren’t these plans expensive to offer?

- Several retirement plan solutions are more affordable than you might think. In some cases, your employees help pay for annual costs. Small businesses may also qualify for federal tax credits as further incentive to establish a retirement plan.

- What if I can’t afford to contribute to my employees’ accounts?

- Not all small-business retirement plans require the employer to contribute money. For those that do, your contributions are tax-deductible.

- What if the economy gets worse?

- Many plans offer flexibility in how you run the plan. You may be able to adjust employer contributions, if any, according to your circumstances and profitability. In some cases, you may even be able to discontinue contributions at any time.

- Isn’t it complicated to set up and maintain?

- Today’s small-business plans are relatively easy to set up and operate. Some have no annual Internal Revenue Service (IRS) reporting requirements.

Make it your business to plan for retirement.

Discover the benefits of the right plan for your company.

401(k) Plan

A 401(k), which is widely used across the United States, is a retirement savings account created by the employer. The investment options within the plan are pre-selected and participants choose the funds for their individual 401(k) account.

Participants contribute to their account through payroll deductions on either a pre-tax or post-tax basis. Pre-tax contributions and earnings will be taxed when withdrawn in retirement, post tax contributions and earnings may be withdrawn tax free in retirement. Employees may contribute up to $20,500 with $6,500 additional for those over age 50. Employers may offer a 401(k) match, in which the employer contributes an amount to all eligible participants or follows a matching formula based on a participant’s contribution amount to their own account. An employer can contribute up to 100% of salary with total combined contributions (EE & ER) not to exceed $61,000 ($67,500 including catch-up contributions for employees age 50+).

The Solo 401(k) – The solo 401(k) plan follows the same rules as the employer-sponsored 401(k) including contribution limits and is intended for business owners that do not have any employees

403(b) Plan – Similar to a 401(k) plan, the 403(b) is often used by schools, nonprofits, and religious organizations and other tax-exempt organizations.

Simple IRA

The Simple IRA was created to give small employers with fewer than 100 employees and $5,000 or more in compensation a straightforward way to contribute to their employees and their own retirements.

Employees can elect to contribute to their Simple IRA and the employer is required to make either matching or non-elective contributions to the IRA retirement account. Similar to the other retirement plan options, all employee contributions are made pre-tax, in other words, the funds are transferred from the worker’s salary to the accounts before income taxes are calculated. Thus, by contributing to these types of retirement plans, not only are employees growing their retirement monies, they are also reducing their current income taxes.

SEP IRA

Any size business is eligible to set up a SEP IRA for their employees. This easy-to-administer plan is funded solely with employer contributions and is similar to a traditional IRA account. Further, employers can contribute up to 25% of the employee’s contribution into their SEP IRA account with a $61,000 cap for 2022.

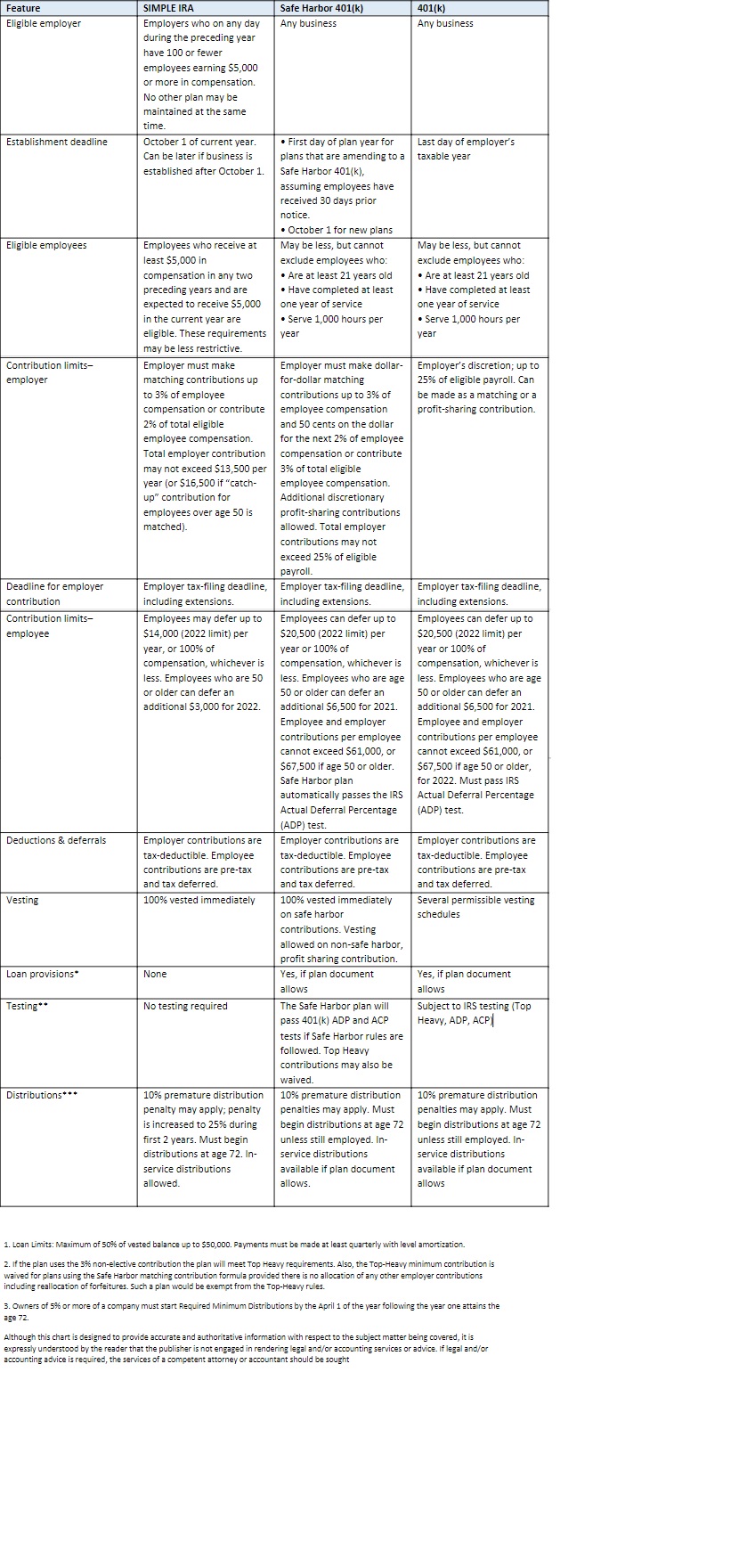

So which type of retirement plan makes the most sense for you? The following chart lays out the details of some of the most popular small employer retirement plans.